Oleg Magni/Pexels

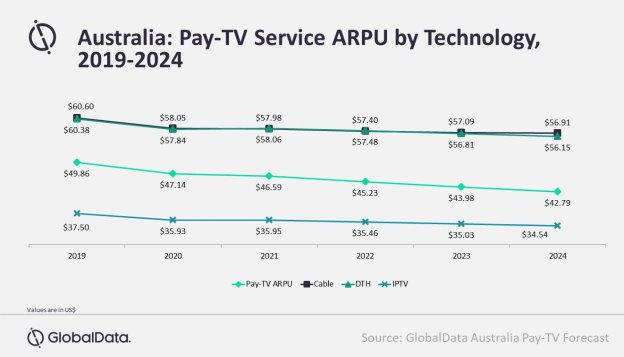

The total pay-TV services revenue in Australia is set to decline at a compound annual growth rate (CAGR) of 3.2 percent from US$2.6 billion in 2019 to US$2.2 billion in 2024 due to the declining cable and direct-to-Home (DTH) TV subscriptions and falling pay-TV average revenue per user (ARPU), according to GlobalData, a leading data, and analytics company.

GlobalData’s Australia Telecom Operators Country Intelligence Report forecasts that pay-TV revenues in Australia will fall sharply in 2020 at a rate of 5.5 percent year-on-year due to the impact of the COVID-19 pandemic on pay-TV ARPUs as the operators offer discounts on pay-TV packages. Pay-TV ARPU in Australia is expected to fall from US$49.86 in 2019 to US$47.14 in 2020.

Deepa Dhingra, Telecom Analyst at GlobalData, says: “The Internet Protocol television (IPTV) will remain the leading platform to deliver pay-TV services in Australia through 2024. IPTV subscriptions are set to grow at a CAGR of 5.4 percent over the 2019-2024, on the back of improving fixed broadband infrastructure in the country that supports the delivery of high-quality IPTV services. Furthermore, the growing adoption of multi-play packages with integrated IPTV services will also support the IPTV growth over the coming years.

“Though Foxtel currently leads the pay-TV market in Australia, the decline in its cable and DTH subscription base will weaken its market position over the forecast period. Telstra is expected to surpass Foxtel in 2022 to become the market leader given its strong focus on providing cost-effective multi-play packages with integrated IPTV services to compete in the market.”