Courtesy of GlobalData

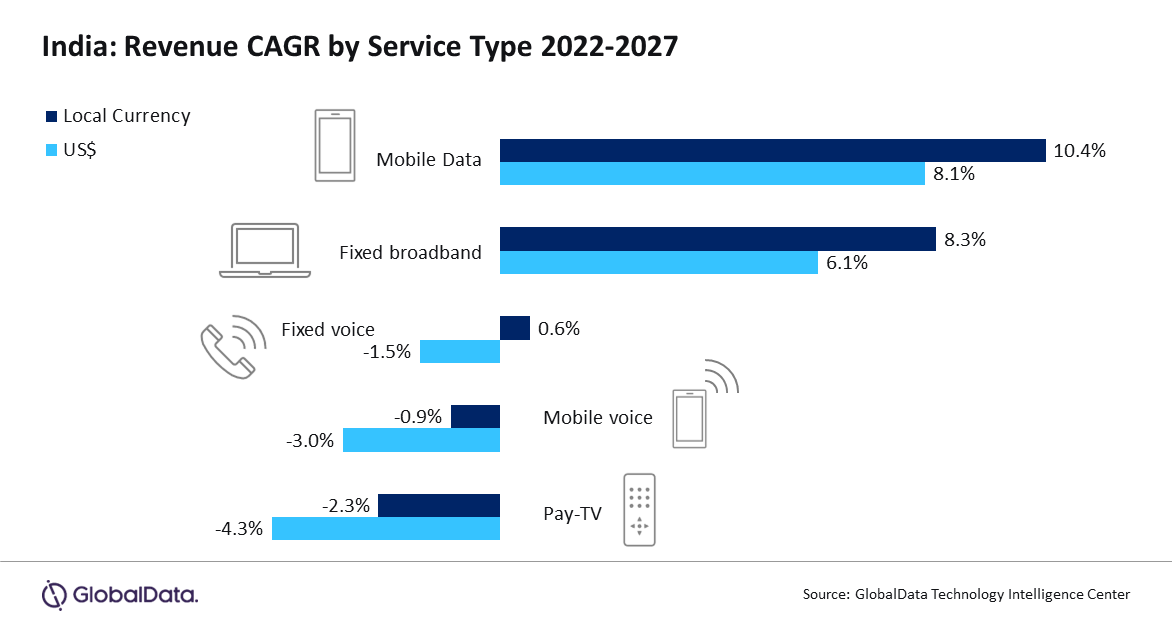

The total telecom and pay-TV services revenue in India is expected to increase at a compound annual growth rate (CAGR) of 3.1% from $42.3 billion in 2022 to $44.9 billion in 2027, primarily driven by mobile data and fixed broadband segments, forecasts GlobalData, a leading data and analytics company.

GlobalData’s India Telecom Operators Country Intelligence Report reveals that mobile voice service revenues will decline during the forecast period due to a steady decline in mobile voice service ARPU, with users increasingly shifting to OTT communication platforms.

Mobile data service revenues, on the other hand, will continue to increase at a healthy CAGR of 8.1% over the forecast period, driven by the continued rise in smartphone adoption, growing mobile internet subscriptions, and increasing consumption of mobile data services on the back of expanding 4G subscriber base and projected rise in the adoption of higher ARPU-5G services.

Sarwat Zeeshan, Telecom Analyst at GlobalData, says: “4G services accounted for majority share of the overall mobile subscriptions in 2022 in India and will remain the leading mobile technology, by subscriber volume through to 2027. 5G subscriptions will grow at a faster rate over the forecast period, driven by the rising demand for and increasing availability of high-speed 5G services in the country as telcos expand their 5G networks across the country. For instance, Airtel aims to extend its 5G coverage to 60,000-70,000 villages by 2023 and achieve nationwide coverage by March 2024.”

In the fixed communication services segment, fixed voice service revenues will decline over the forecast period due to steady losses in circuit-switched subscriptions and declining fixed voice ARPU. Fixed broadband service revenues, on the other hand, will increase at a CAGR of 6.1% over the 2022-2027 period in line with the steady rise in fixed broadband subscriptions, particularly over FTTH/B access lines.

Zeeshan adds: “Growing demand for and increasing availability of higher-speed fiber broadband connectivity on the back of the government’s efforts to expand fiber network infrastructure across the country will drive the adoption of fiber broadband services over the forecast period. For instance, in August 2023, the government approved $17.4 billion for the final phase of the last-mile optical fiber-based broadband connectivity plan, spanning 640,000 villages across the country under the BharatNet project in the next two years.

Pay-TV service revenues in the country will decline over the forecast period due to the continued drop in cable TV, DTH, and IPTV subscriptions and falling pay-TV ARPU levels as a result of the ongoing user migration to OTT-based video service platforms.

Zeeshan concludes: “Reliance Jio led the mobile services segment, in terms of subscriptions in 2022, followed by Airtel India. Reliance Jio will continue to hold the top position throughout the forecast period, thanks to its competitively priced 4G packages and the accelerated pace of its ongoing 5G service expansions through which it hopes to meet the rising demand for high-speed services among residential and business customers. The operator also leads the country’s fixed broadband services market in terms of subscriptions, supported by its strong position in the growing fiber broadband services segment and efforts to expand its JioFiber network.”