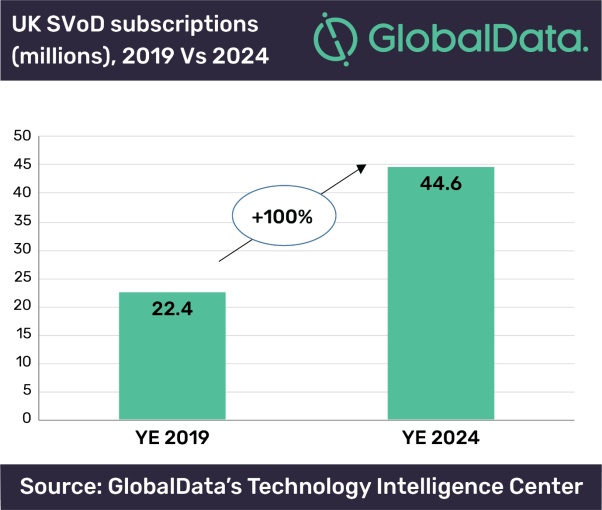

The UK’s solid growth in subscription video on demand (SVoD) adoption is set to continue over the next five years, according to GlobalData, a leading data and analytics company. The total number of SVoD subscriptions is expected to double between 2019 and the end of 2024, rising from 22.4 million to 44.6 million. Total market revenue, exclusive of VAT, is expected to also double from £1.5bn in 2019 to £3bn in 2024.

Joel Cooper, Senior Director, Telecoms Market Data and Intelligence at GlobalData comments: “Prior to COVID-19, the SVoD market in the UK was experiencing a high rate of growth, with no sign of plateauing. While there will be some impact on SVoD adoption from the economic fallout from COVID-19, GlobalData expects this to be outweighed by a combination of lockdown-driven adoption and consumer take-up of new services such as Disney+. The market is expected to experience a record-level subscription growth in 2020 on a net additions basis”.

The UK’s SVoD market has traditionally been dominated by Netflix and Amazon Prime Video, with Sky’s NOW TV in third place.

Cooper continued: “The recent launch of Disney+, Apple TV+ and BritBox provides consumers with more choice and will help propel market growth. Disney+’s impact is expected to be particularly pronounced given its brand power, breadth of premium content and low price”.

In the US, Disney+ acquired approximately 25 million paying subscribers just two months after launching in November 2019, equivalent to around 10% SVoD subscriber market share.

Cooper concludes: “SVoD in the UK is a long way from saturation point. The market represents a clear opportunity for existing players as well as potential new entrants.”

Information based on GlobalData’s report: UK SVOD Forecast, May 2020