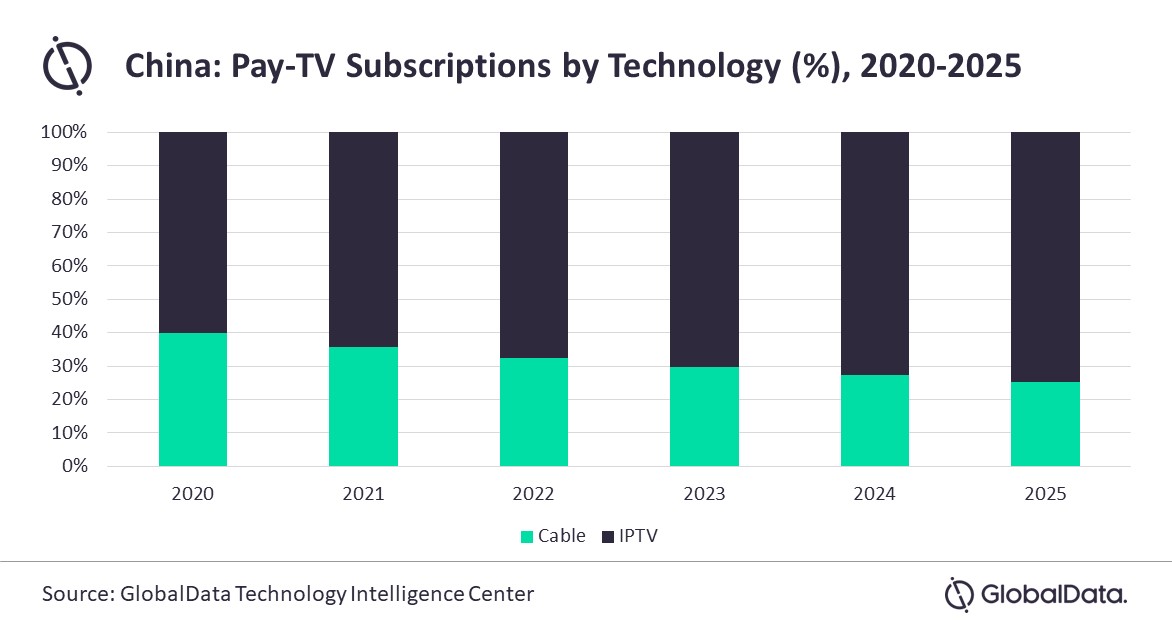

Courtesy of GlobalData

The total pay-TV services revenue in China is set to decline at a compound annual growth rate (CAGR) of 0.5% from US$32.9bn in 2020 to US$32.1bn in 2025, due to the growing preference for over-the-top (OTT) video streaming services and falling pay-TV average revenue per user (ARPU), according to GlobalData, a leading data and analytics company.

An analysis of GlobalData’s China Pay-TV Forecast Model reveals that cable TV subscriptions will decline at a CAGR of 7.6% over 2020–2025 due to a widespread cord-cutting trend. Internet protocol television (IPTV) subscriptions on the other hand will grow at a CAGR of 5.8% over the same period.

Akash Jatwala, Senior Research Analyst of Telecoms Market Data and Intelligence at GlobalData, says: “IPTV will be the leading pay-TV service platform in China in terms of subscriptions during 2020-2025 and will account for 75% of the total pay-TV subscriptions by the end of 2025. This growth will be primarily driven by the strong fibre-optic network penetration in the country that supports the delivery of IPTV services. Furthermore, competitive pricing and bundled plans offered by major pay-TV operators will drive IPTV subscription base over the forecast period.

“China Mobile will remain the leading pay-TV service provider over 2020-2025, supported by its strong foothold in the IPTV segment. The operator’s leadership position can be attributed to its acquisition of fixed operator China Mobile Tietong and rapidly deploying fiber-optic network, which enables it to deliver high-quality Video on Demand (VoD) services through Mobaihe set-top box to attract new subscribers.”