The recent deployments of PPV and even VOD/SVOD have been primarily driven by platforms looking for competitive advantage, and to reduce subscriber churn. And as demand for applications surges in the region, emerging technologies such as IPTV and mobile TV are opening up new revenue streams for broadcasters and content distributors. Be it the launch of BBC Worldwide’s Global Channels first subscription video-on-demand (SVOD) service, BBC HD, for Taiwanese audiences with Chunghwa Telecom; or Sony Pictures Television International (SPTI) signing a video-on-demand (VOD) licensing deal with South Korea’s largest mobile operator, SK Telecom, such deals are growing in number. While platform owners are encouraging their subscribers to consume more content, this provides broadcasters and distributors with an opportunity to associate themselves with their viewers in a new manner. “IPTV and mobile TV provide incremental opportunities for growing our reach and interactivity with our audience,” acknowledges Robert Kim, senior director, digital media, MTV Networks Asia. “Both technologies, IPTV and mobile TV, have many advantages which sets the expectation that they will be dominant in the future, but it is not clear when that will be realised it is unlikely to be in the next three years. Therefore, we are fully engaged in various experimentations and are opportunistically pursuing partnerships,” said Kim. According to Jacqueline Lam, head of network distribution, CNBC Asia Pacific, “Emerging broadcasting platforms present new opportunities for growth not just in acquiring new subscribers, it stimulates the competition in the market place, creates a check and balance across service, price, and application standards. Overall, it’s a positive environment for all parties in the value chain including consumers, content providers and platform operators.” Lam added that on demand applications have great potential to gain momentum in the next few years. Attractive pricing and convenient access to preferred shows will lure subscribers to the service. “Content such as business news that CNBC produces, will be immune to the impact for on demand applications as real time, live broadcast and breaking news remain crucial to its core audience,” she added. From SPE Networks’ perspective, general manager for Asia, Ricky Ow said it isn’t surprising to see so many upgrades and investment across Asia in these areas. “It represents new revenue opportunities for existing channels such as AXN and Animax. For new channels and initiatives such as Sony Entertainment Television and Animax Mobile, it gives us the opportunity to reach viewers differently. Viewers get the chance to be presented with new options and more choices. All in all, there will be more choices, more competition, but a bigger pie for all of us in the future,” said Ow. The current momentum is exemplified by the fact that distributors are tailoring content for new media platforms. For instance, SPTI has a dedicated Mobile Entertainment team which has brought to the market Animax Mobile TV and its multi-platform series Afterworld. Janet Eng, director of sales at SPTI says there are tremendous opportunities “as we are one of the few, if not the only, Hollywood studio to manage the distribution of PPV, VOD, mobile rights etc under one division.” “IPTV and mobile TV are spreading throughout the region, but the focus markets are definitely those that have high broadband penetration (for IPTV) or high mobile broadcast capability (for mobile TV). Korea, HK, Taiwan and Singapore are definitely focus markets with China, India and many other countries growing in potential. Japan/Australia/NZ are covered by our local offices in those countries,” said Eng. Assessing the current opportunities arising from IPTV, Christine Fellowes, managing director – Asia Pacific, Comcast International Media Group, says, “IPTV is opening up some new opportunities for content sales involving VOD and SVOD. In Korea, the IPTV platforms operated by Korea Telecom and Hanaromedia have shown interest in acquiring diverse genre. We expect demand for our programming from CIMG’s diverse lifestyle brands to increase as platforms such as mio TV in Singapore, now TV in Hong Kong and Chunghwa in Taiwan, ramp up their offerings.” She, however, added that with broadband penetration still relatively low in many Asian markets and regulatory issues such as regulatory jurisdiction between Telecommunications and Broadcasting Authorities, IPTV is still to roll out in most Asian markets. Referring to key markets with immediate potential for IPTV, Fellowes said in Japan, currently, IPTV is operated by Yahoo! BB and NTT and has been somewhat stifled by lack of content (regulatory barriers to IPTV rebroadcasting HD DTT), lack of marketing and pricing. “Korea is a market with high broadband penetration. Telcos like KT Telecom & Hanaro have already been operating pre-IPTV services and VOD has been growing. CIMG has been very successful with licensing branded content to these platforms. With upcoming regulatory change that allows telecom carriers to offer IPTV nationally in Q4 2008, Korea is positioned to become an attractive market for IPTV,” she said. On Taiwan, she said regulatory issues have left Taiwan’s digital development behind other Asian countries. “Analog cable is at full capacity and migration to digital is very slow. While the launch of Chunghwa’s IPTV platform offers an alternative to subscribers, developing a compelling consumer offering from a content position is challenging,” she said. “Hong Kong is a smaller market but IPTV, through now TV, is gaining a formidable market share. For content providers there are limitations due to the content marketing on the platform. Additionally, localisation is required so revenues are still conservative. Singapore and India are also seeing the launch of new IPTV platforms, and these represent future opportunities.” Regarding mobile, Fellowes said one of the major success factors is the operator’s retail strategy. “In many markets operators are still developing a workable approach to packaging and the consumer proposition. Our observation, in dealing with many operators across the region, is that the simplest business model is the most successful e.g. Unlimited access to a variety of strongly branded channels for a specified fee. In the early stages of the business the challenge is to entice subscribers to use mobile phones to pay for and watch content. Providing clear, accessible options has proven to be the most successful approach,” she said. Specifically, she said Korea and Japan lead in advanced technologies such as one-seg and S-DMB, respectively, “However, one-seg in Japan has been reserved to simulcasting local free-to-air channels only. There has been more opportunity with S-DMB in Korea as the platform is licensing foreign content. These markets will continue to set the pace in terms of Mobile TV in the region.” On Singapore, Fellowes said, “With mobile penetration at very high levels, 3G take up overall has been disappointing. With additional DVBH licenses available this year, mobile TV has a renewed opportunity to flourish.” In Australia and New Zealand, all of the major mobile operators have successfully launched a service on their 3G platforms. There also have been trials with DVBH which could result in interesting new opportunities. The proposition may be attractive but there are number of factors which need to be taken into consideration. Consumer behaviour in Asia is characterised by differences in the level of macro economic development and the maturity level of access technologies and its infrastructure. SPTI’s Eng says, as with all content providers, the company is concerned about DRM and the security of its content. “But what we are looking for more than that are platform partners with sound business plans, a long-term focus and a willingness to work together to promote the content,” she said. For its part, Disney-ABC International Television (Asia Pacific) believes that every market has a unique mix of multi-platform dynamics, so Disney-ABC approaches the Asia Pacific region on a territory by territory basis to seek solutions that make sense for both its business and its partners. “At the end of the day it’s about finding the right home for our hit franchises and programming as well as building relationships with partners that respect and value our content and brands,” said Rob Gilby, senior vice president and managing director, Disney-ABC International Television (Asia Pacific). Gilby’s team recently closed two IPTV VOD deals in Korea for movies and series on Hanaro Telecom’s hanaTV and KT’s Mega TV, making series such as Grey’s Anatomy and Desperate Housewives available for the first time on-demand in Asia. In the last year, it also launched the company’s first ever international SVOD movie channel, The Film Factory, on mioTV (IPTV) in Singapore. And in New Zealand it was the first US studio to deliver network series such as Brothers & Sisters and Criminal Minds to TVNZ ‘ondemand’ broadband users. “With our pioneering iTunes deal in the US (to make episodes of our series available for sale on Apple’s iTunes Stores) we were able to identify a set of criteria that can be applied to all our new media opportunities. These criteria include working with partners that: deliver a quality consumer experience; have a sound growth strategy based on delivering value to the consumer; put a priority on marketing and promotion; and who will value and protect our content,” he said. CNBC’s Lam said understanding and appreciating new platforms’ strategy for growth and expansion provides a sense of the outlook for the platform’s commercial success. Content encryption, secured distribution environment and addressable subscriber count are basic criterion for signing such deals. “Our biggest concern is business sustainability as new platforms will be experimenting different models to build their growth. Securing additional distribution content rights for new platforms becomes a risky proposition for unproven business models,” Lam added. SPE’s Ow says his company considers four key factors: – security to protect intellectual property; potential commercial success; marketing plan and commitment behind the new platform; a commitment to the consumer experience. CIMG considers following factors before signing deals for Mobile TV: retail strategy (pricing, packaging, and content brands), subscriber growth forecasts, strategy for penetration growth in the marketplace and content rights for programming. For IPTV, it considers technology used for delivery (ie. to STB & TV set), subscriber projections, packaging, pricing and exclusivity/non-exclusivity. On what impact such technologies have in terms of demand for content, Disney-ABC’s Gilby says, “We believe that technology expands our opportunity to tell a good story. People still love a good narrative, and I don’t think that will change. So you use technology to make the story better and to reach more people. For example, our award-winning show Desperate Housewives, (licensed to 25 different broadcasters across Asia Pacific) is available on six different platforms including VOD in Korea – the most of any territory worldwide for Disney. In our experience the different platforms provide an opportunity for audiences to deepen their connection with a hit show, and this creates additional value for our partners across all platforms.” Sharing his viewpoint on the same, MTV’s Kim first points out that IPTV is expected to have a relatively small share of the broadcasting industry over the next three years. He added, “However, in some markets, when launched effectively, can become a major player. PCCW is the classic example. For new technologies, there is strong evidence that the content available on the platform is a major factor for success which was reinforced by PCCW. As a result, the demand for compelling, high-quality content increases in a market where a new platform is being launched. The demand also comes in both ‘offensive’ and ‘defensive’ forms. Increasing demand for our content is always good.” SPE’s Ow feels there will be more investment into production as there is potential for bigger distribution revenue. For instance, AXN has produced The Amazing Race Asia for various screens – whether it is for mobile or for IPTV. Advertisers, channels and operators will also be eager to find advertising solutions through the new media platforms, according to him. Citing an example of one such relationship, Ow shared that Animax has announced its first original animation production called LaMB. Besides being able to watch the movie on Animax, viewers can also watch a series of mobisodes tweaked in sequence to get a different perspective of the show. Other promotional activities include mobile and online games, as well as web manga and a graphic novel that serve as prequels to the movie. “LaMB is created by the viewer for the viewers, and made available on all screens to target today’s youth who are essentially ‘digital natives’. Not only are we developing this into a huge campaign to connect with viewers across all touch points, we are also offering advertisers unique branding and product integration opportunities at every of our connection points,” explained Ow. In terms of differentiating IPTV or mobile TV in terms of specific genres, there is a mixed viewpoint among the companies. SPTI’s Eng says good content transcends all platforms. “Our blockbuster movies and TV shows perform well whether they are seen via cable channels, IPTV VOD services, mobile on demand services or mobile TV.” “It’s still too early to draw definitive conclusions,” said Gilby. “We do cover every demographic and just about every interest. Have said that, for IPTV, we’ve seen strong interest for our series and features on VOD and SVOD models.” For his part, MTV’s Kim said, “For mobile TV, most of MTV’s original programming suits this format because they have been developed for the `short attention span’ youth and we further condense them into mobisodes. Shows like Punk’d, Boiling Points and Scarred are also broken up into short segments of novel or fun content.” He added, “For IPTV (VOD), shows like Laguna Beach and Real World may be particularly well suited since they are a series and the audience can watch an entire season over a weekend (like drama DVD’s).” SPE’s Ow says, “In general, sports and entertainment programmes will be the biggest drivers for these new platforms.” CIMG’s Fellowes said for VOD/SVOD, regardless of whether delivered via IPTV or cable VOD platform, feature films and sport are driver content. “Comcast have also seen that special interest content presented in branded suites represent exciting ‘on demand’ opportunities. For instance, Exercise TV is one of the most popular VOD channels in the US as home-fitness users visit the video destination on a regular basis,” she said. Fellowes added, “For Mobile TV, the three key genres are news, sports and entertainment.” From revenues’ perspective, Gilby said it still may be too early to say but he is cautiously optimistic. “On-demand and digital platforms account for a modest percentage of our overall revenues today but we project this increasing significantly over the next few years. We are confident that all these new media platforms represent a next wave of potential distribution growth for our business,” he said. SPTI’s Eng refused to share details of deals, but mentioned that these deals contribute to company’s bottom line.TVAplus

Ad – Before Content

Related Articles

Paramount+ and MTV announce Dating Naked UK has been renewed for a second series

Gyeongnam Culture and Arts Foundation Invests in Ikegami UHK-X700 4K-UHD HDR Cameras

LFP Media Transforms Video Experience and Maximizes Revenues with the Bitmovin Player

Iceland’s Glassriver options Reykjavik Noir trilogy from Lilja Sigurdardottir for series adaptation, picked up by broadcaster Síminn

OOONA Partners with Audio Description Associates, LLC

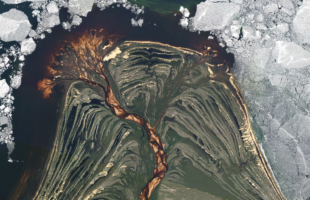

Fremantle has acquired the global distribution rights for Atlantic Productions’ Earth: A Year In Orbit