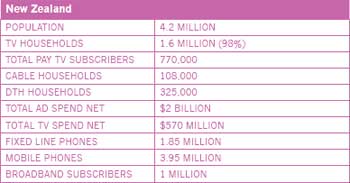

The New Zealand television advertising market is slightly behind the huge bounce being found across the Tasman in Australia, but TV ad revenues have still recovered at an amazing rate from the doldrums of the global financial crisis barely 18 months ago.