Courtesy of S&P Global Market Intelligence

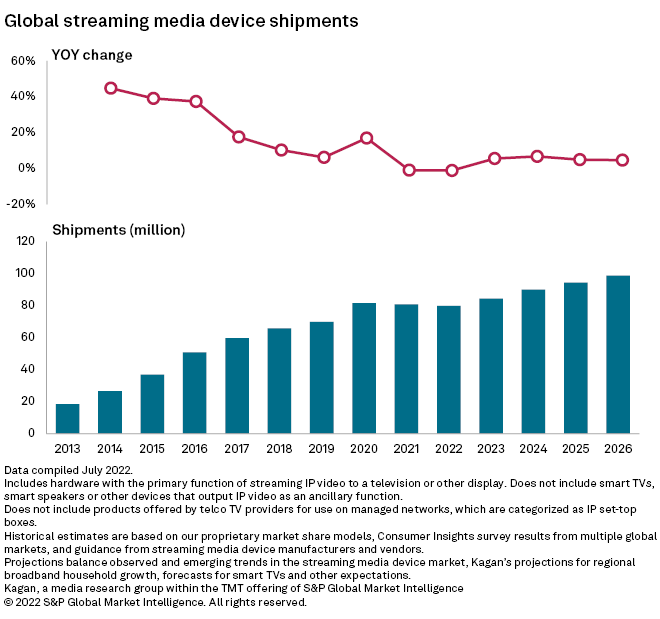

Global streaming media device shipments are expected to fall 1.2% to an estimated 80.0 million units in 2022 as inflationary pressures keep many consumers on the sidelines, according to Kagan, a media research group within S&P Global Market Intelligence.

Key highlights from the analysis include:

- The surge in demand for internet video in the early days of the pandemic led to a flood of streaming media device (SMD) shipments, which drained volumes that would have otherwise emerged in late 2021 and 2022.

- Furthermore, chip shortages and complications in logistics have scrambled the low-margin hardware’s business model. Consequently, vendors have been unable to substantively overhaul their product lineups, which has stalled growth in mature markets, or to significantly drop prices, which has stunted expansion campaigns in emerging markets.

- However, S&P Global Market Intelligence anticipates the market will return to growth as early as 2023 as market forces swing back in favor of low-margin hardware production. They forecast a 4.1% compound annual growth rate (CAGR) for SMD shipments from 2021 through 2026, enough to push the market close to 100 million units in 2026.

- They also estimate the global SMD installed base hit 232.6 million as of the end of 2021 and is set to grow to 313.5 million by the end of 2026.

* This analysis includes streaming media players, such as Apple TV, and streaming media sticks, such as Amazon’s Fire TV. This analysis does not include smart TVs, smart speakers, game consoles or other devices with ancillary video streaming functions.

Neil Barbour, a research analyst at S&P Global Market Intelligence said, “The primary challenge to a steeper growth curve for SMDs is the persistent evolution in smart TV interfaces and processing power. As smart TVs become more capable streamers, there is less demand for external hardware solutions. SMD vendors appear to recognize the threat and have actively sought partnerships to deploy their operating systems on smart TVs.”